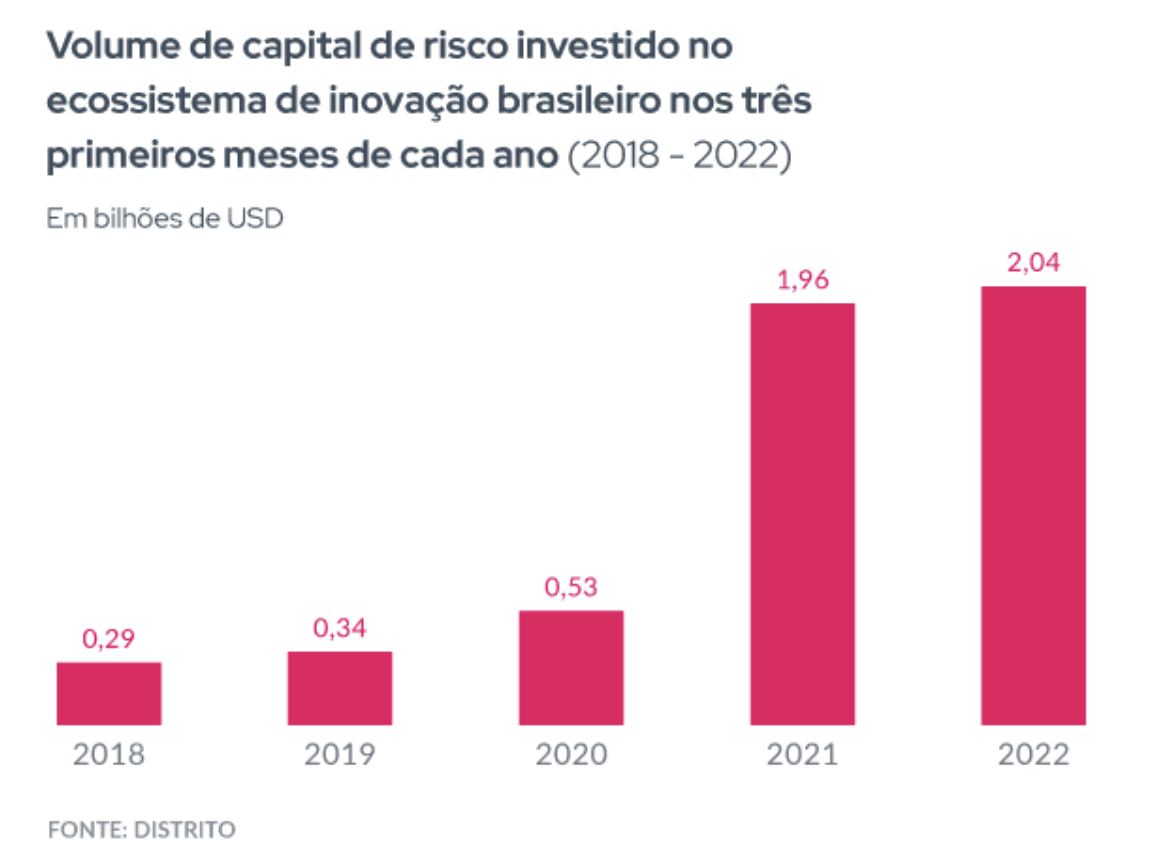

Data from the District show that risk investments in the innovation segment in Brazil have already exceeded US$ 2 billion, above the same period (first quarter) of last year, considered an excellent year for the sector.

According to the survey, this total was reached through 167 rounds of negotiations, against two hundred in the first quarter of 2021, revealing a higher value per transaction this year compared to last year.

The assumption that the risk investment market should receive a major impact from the growing global economic crisis, notably caused by the uncertainties of the war in Ukraine, is true.

Ditto the projections that point, as a reflection of this scenario and already in progress, to the growth of inflation in all the major markets of the world. Brazil already suffers this inflationary effect clearly. And it will continue to feel, possibly, in the next two years. We are not an island.

However, pay attention: the market for risk and investments in startups (read, the market where innovation is born and accelerates several other sectors of the economy) in general and historically tends to be a sector that passes in a less painful way for moments like this.

See what the chart below tells us. And conclude for yourself.

Follow news through the website https://pipeline.capital

and also from LinkedIn

and Instagram