By Pipeline’s International Contributor in Paquistan, Hammad Kashif

The current world economic conditions are a complex and ever-changing landscape, but one thing is sure: they directly impact every individual’s livelihood. From the global pandemic to the increasing cost of living, it’s clear that the world’s economies are in a precarious position. But despite the challenges, there are also many opportunities to be taken advantage of. The recent global economic crisis has significantly impacted the global economy, but many countries are now starting to recover. This comprehensive overview of the current world economic conditions will provide an in-depth look at the current state of the global economy, exploring the factors that shape it, the trends that are influencing it, and the potential it holds for the future. With this knowledge, individuals and businesses can make informed decisions to help ensure a prosperous future.

Overview of Global Economic Conditions

The global economy is an ever-expanding system of trade, supply chains, and international finance that connects all countries worldwide, linking their financial and commercial systems in a complex network. This network is a complex system whose parts and components depend on each other for their survival, and its interconnectedness provides the global economy with its strength. The global economy is currently experiencing an economic slowdown. This means that many countries are experiencing lower economic growth and a higher unemployment rate. Although the current global economic situation is not expected to result in a worldwide economic crisis, many challenges are still facing the global economy.

The global economy is generally divided into two main and distinct areas: the developed world and the emerging markets. The developed world refers to countries that are considered to be industrialized, highly developed, and wealthy. These include North America, Western and Central Europe, Australia, and Japan. The emerging markets are less developed countries experiencing rapid economic growth and development. These include a large portion of Asia, most South America, and some less developed countries in Africa. In general, the current state of the global economy is strong and growing. The global gross domestic product (GDP) reached almost $96.5 trillion in 2021, significantly increasing from $85.1 trillion in 2017. The global unemployment rate is also at its lowest in decades, currently at 6.1%.

Impact of the Global Pandemic

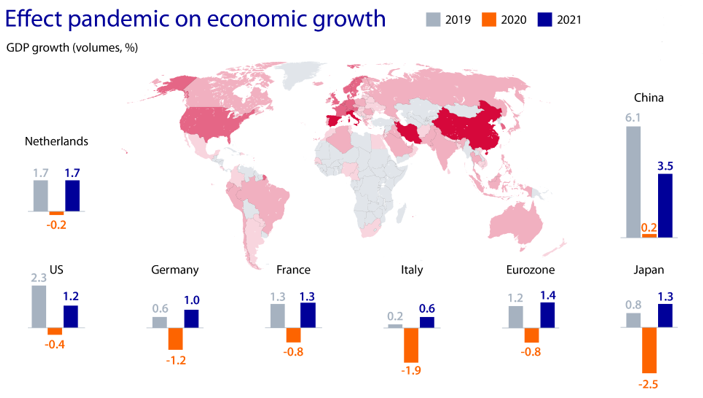

In 2018, a deadly strain of avian flu known as H10N8 spread worldwide, infecting millions of people and killing thousands. This pandemic was particularly problematic because it was a type of flu that had never been seen before, meaning that the human race did not have any immunity to it. Therefore, the global human population had no way to fight the pandemic naturally, and many people were left without a way to treat it or prevent it. Such a pandemic significantly impacted the world’s gross domestic product (GDP). The World Health Organization (WHO) reported that the economic cost of the pandemic was $329 billion. Such a loss of GDP is truly a devastating blow to the world economy and can have long-lasting effects. GDP is a valuable and significant indicator of the current state of the world economy because it allows economists to measure and understand the total value of all goods and services produced in a given period within a specific geographic area.

Trends in Global Economic Growth

Global economic growth has been a central focus of economic analysis and policy-making in recent decades. There have been various trends in global economic growth that have shaped the current state of the world economy.

Shift in the Global Economic Center

One trend evident in recent years is the shift in the global economic center of gravity towards developing countries. Countries such as China and India have experienced rapid economic growth and have become significant players in the worldwide economy. This has led to a shift in the balance of economic power, with developing countries now accounting for a larger share of global economic activity.

Increased Interconnectedness of the Global Economy

Another trend that has been observed in recent years is the increased interconnectedness of the global economy. The growth of international trade and investment has led to greater economic integration among countries. This has brought benefits and challenges as the global economy becomes more vulnerable to economic shocks and financial crises.

Growing Importance of Technology & Innovation

A third trend observed in recent years is the growing importance of technology and innovation in driving economic growth. The rapid advancement of technology has led to increased productivity, economic development, and new opportunities for businesses and individuals. However, it has also led to increased competition and the displacement of jobs in specific sectors.

Concern About Inequality

Finally, there has been a growing concern about inequality and its impact on economic growth. In many countries, income and wealth inequality has been on the rise, which has led to a growing sense that the benefits of economic growth are not being shared equally among all members of society.

Ongoing Trade Tensions

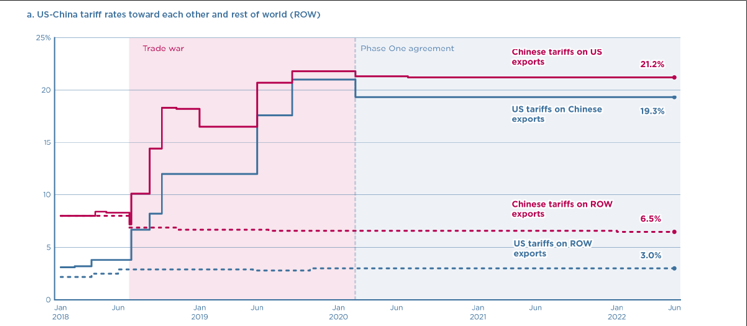

Trade tensions between the U.S. and China have negatively impacted the global economy. These tensions have led to increased tariffs on goods being imported and exported between the two countries. Tariffs totaling $250 billion have been imposed by the United States on Chinese goods. China has responded by imposing $110 billion in tariffs on US goods. This has led to higher prices for imported goods from China and decreased demand for exported goods from the U.S. This has negatively impacted economic growth and led to job losses in both countries. Other countries affected by these trade tensions include Canada, Mexico, and the European Union. These countries have imposed tariffs on goods imported from the U.S. in response to U.S. tariffs on Chinese goods. This has contributed to a decrease in economic growth in these countries. It has also negatively impacted the economies of the EU and Canada, which are important trading partners of the U.S.

The Global Economic Forecast

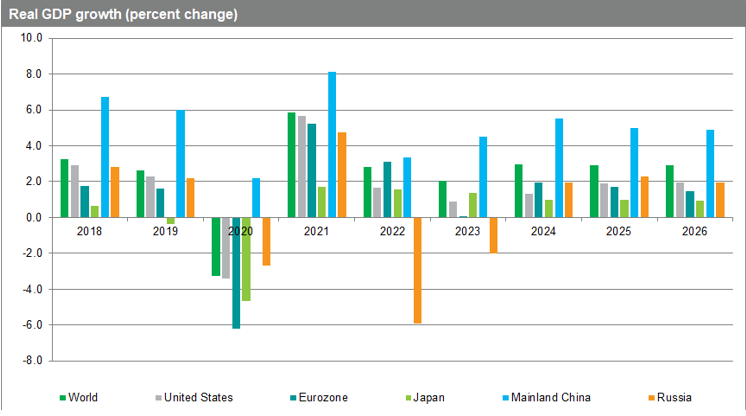

The global economic forecast is a projection of the likely path of the global economy shortly. The forecast is based on various factors, such as economic indicators, political developments, and market trends. Currently, the global economy is facing the impact of the COVID-19 pandemic. The pandemic has led to a severe economic downturn, with many countries experiencing negative growth and high unemployment. As a result, the global economic forecast for the near future is uncertain and subject to change. That being said, the economic forecast for the next few years suggests that the global economy is expected to recover from the pandemic-induced recession. Still, the recovery is likely to be uneven across countries and sectors. Global economic growth is expected to be 1.7% in 2023 and 2.7% in 2024. The sharp decline in growth is expected to be widespread, with forecasts for 95% of advanced economies and nearly 70% of emerging market and developing economies revised downward for 2023. The forecast also suggests that the pandemic has accelerated the global economic center of gravity shift towards developing countries. Countries such as China and India are expected to lead the recovery, while advanced economies such as the United States and Europe are expected to face more challenges soon.

Conclusion

The current world economic conditions are a complex and ever-changing landscape. While the global economy is generally stable and prosperous, some areas are experiencing problems. For example, the cost of living and inflation in the world economy are both rising. The current state of the global economy suggests that it is an excellent time to begin taking advantage of the many opportunities that exist within it. The current global economy is expected to grow steadily throughout the next few years, and there are many ways individuals and businesses can take advantage of this fact to improve their financial situations.

By Pipeline’s International Contributor in Paquistan, Hammad Kashif

Follow news through the website https://pipeline.capital

and also on LinkedIn

and Instagram