Text by Pyr Marcondes, Senior Partner at Pipeline Capital.

Pipeline Capital is called “pipeline” because my partner, Alon Sochaczewski, is a surfer, and because he (like me) believes that opportunity and evolution in the capitalist world come in waves. And because we also like to believe that we are good at surfing them.

Well, not to stay here using my own arguments to defend (as he and I have defended in our articles recently) that the market is getting ready for a new wave of mergers and acquisitions, and that the world of startups will be one of the first to to catch this wave, I quote here arguments from the portal specialized in the subject, Mergers and Acquisitions, which in turn cites an analysis of the Harvard Business Review.

Already in October, they stamped the following headline: “Preparing your startup for the next wave of mergers and acquisitions”.

See who used the expression “onda” they were, okay?

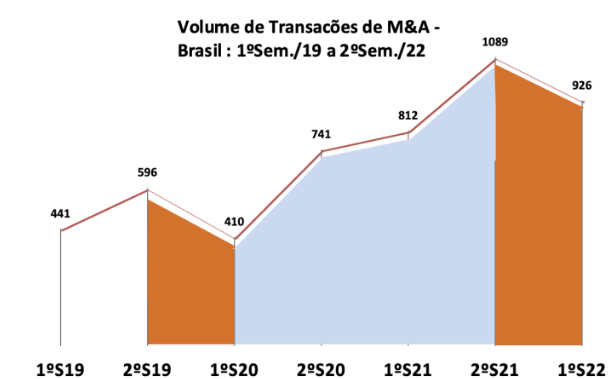

Very good. Now look at this chart they published in the text.

Do you see there a picture of a shrinking market? Well, not me. Not Alon. Not Pipeline. Neither do they.

Also according to the text of the Harvard Business Review… “When acquisition waves start, they move very quickly. Knowing who belongs on your shopping list and how to get on another company’s list can make the difference between finding the right partner and settling for a smaller one.”

From there, Harvard Business Review discusses the main concerns and actions that the startup entrepreneur must take into account.

Read the full text by clicking on the link below. But if you have a startup, bear in mind that the sea is about to wave and that if you don’t row now, you’re going to take a huge toll on the loss of momentum

Follow news through the website https://pipeline.capital

and also from LinkedIn

and Instagram