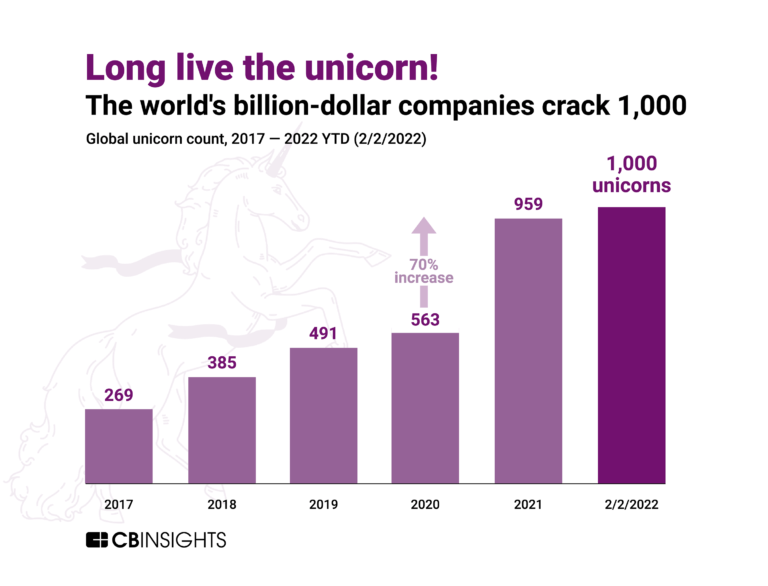

1,000 unicorns: Global billion-dollar private companies reach four-digit milestone.

Matter translated from CBInsigths.

2/2/2022, the aptly named Year of the Tiger, was historically landmark. The worldwide unicorn club reaches 1,000 members with valuations of over $1 billion. Here are the key stats you need to know:

GLOBAL HIGHLIGHTS

Main categories:

1- Fintech is the largest category of unicorns, representing approximately 1 in 5 unicorns (21%);

2- Internet Software and Services (18%);

3- E-commerce and direct-to-consumer companies (11%).

Main geographies:

- United States is home to the most unicorns (51%);

- China (17%);

- India (6%).

Follow news through the website https://pipeline.capital

and also from LinkedIn

and Instagram