Text by Pyr Marcondes, journalist, publicist, consultant, publisher, author, investor, M&A Tech Advisor. He is a Senior Partner at Pipeline Capital.

The global economic recession or even a possible stagflation hitting more dramatically the most fragile or growing economies (Brazil included) – as predicted by the World Bank in its last report (I talked about it in another post) – should last two years or even more.

But the investment industry, which more than once in history has proven itself as a sector with its own dynamics reasonably detached from the classic indicators of macroeconomics, should undergo readjustments more quickly

Today, this market is not at a standstill, but is visibly more conservative and cautious. In fact, it continues to look for opportunities, as many assets (startups, scale ups, Series A most notably) could present themselves as excellent investment and purchase options right now.

But in 3 to 6 months we should go through a first moment of recovery, when the valuations, currently crushed, will settle down to a new, more stable and readjusted level, since they were excessively swollen. This will make the early movers move. They will lead the investment push, which will tend to flow more organically, albeit at a slow and gradual pace.

The investment industry will then begin to realize that stagnating for a longer time is not good business, as always, in any market, the first ones that move with a perspective of growth ahead, even with present volatility, tend to profit more and better with it.

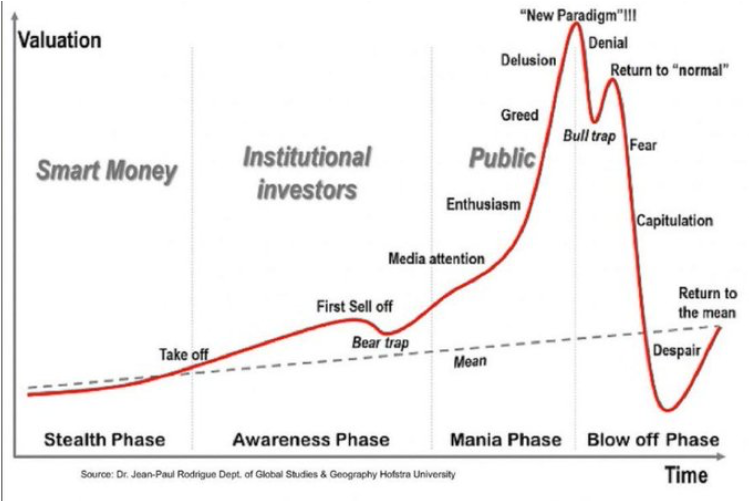

See below, this is the graph of the despair of the markets. Many react this way. Investments are no different.

The manic phase (as in bipolar disorders) we have lived for the last 10 years. In the last 6 months, we have lived through the phases of Fear, Capitulation and, right now and in the coming months, we will be living through the phase of Despair.

But it will pass and we will return, at a pace that I believe will be as follows.

A new phase should take place in 6 to 12 months, in which this recovery will be much more evident. Series B, C and D should be resumed in stages, as one depends on the other, in a chain that pulls all the links down at a time like this, but which also pulls those same links up, when financial oxygen returns to irrigate the markets.

Unicorns will inevitably come out ahead devalued compared to the recent past and will have to live with a new level of value.

The big techs, also dramatically affected in the value of their shares, will live a kind of island of their own, since they are today facing not only economic and financial challenges, but questioning their own identity in the capitalist market. Even during this period that will follow, several of them will reach a market cap above a trillion dollars (greater than some countries) and this is new data.

In 18 months, the market should have resumed its route.

We will also see labor layoffs in the coming months. We will see companies crashing. We will see entrepreneurs in a more anxious search for cash, since the moment of longer-term cash burn is over and now the market is looking for more positive spreadsheets and projections.

But like every crisis, this one too shall pass. And those who know how to position themselves in a more agile, intelligent and strategic way will come out of it financially rewarded.

Text by Pyr Marcondes, journalist, publicist, consultant, publisher, author, investor, M&A Tech Advisor. He is a Senior Partner at Pipeline Capital.

Follow news through the website https://pipeline.capital

and also from LinkedIn

and Instagram