Text originally published on Portal Fusões e Aquisições.

The Brazilian M&A market in May 2022 is catching its breath. The Information Technology, Energy Companies and Telecommunications and Media sectors were the most active and national investors predominated.

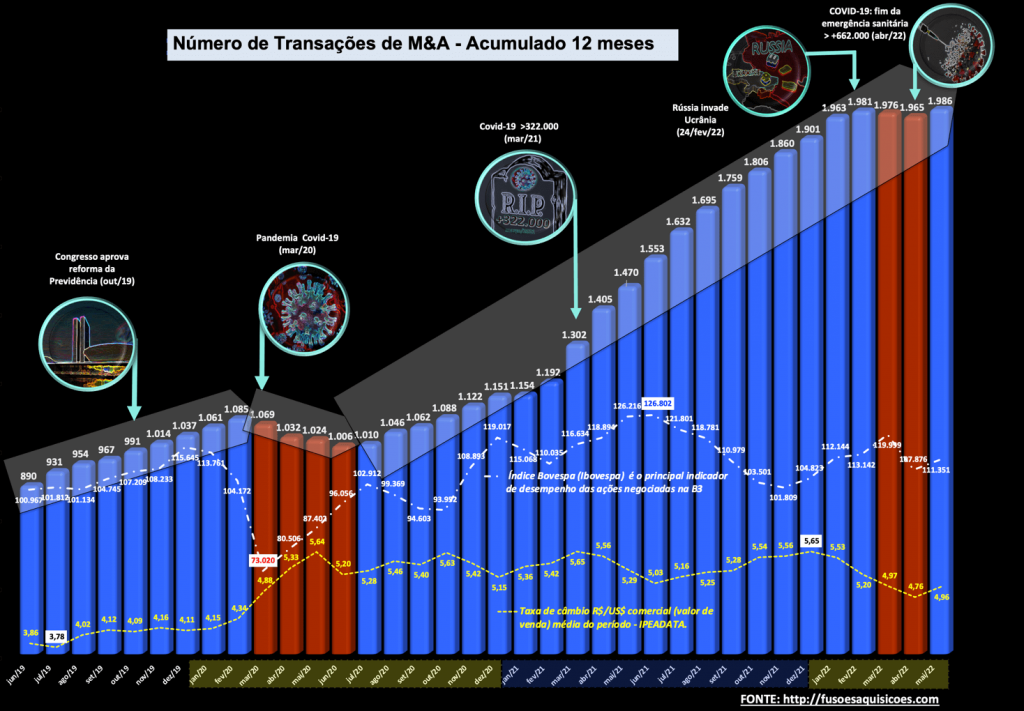

Increase of 1.1% in the last twelve months, 1,986 operations, compared to the same period of the previous month. In relation to the accumulated of the 12 months until May/21, the increase is of 35.1%.

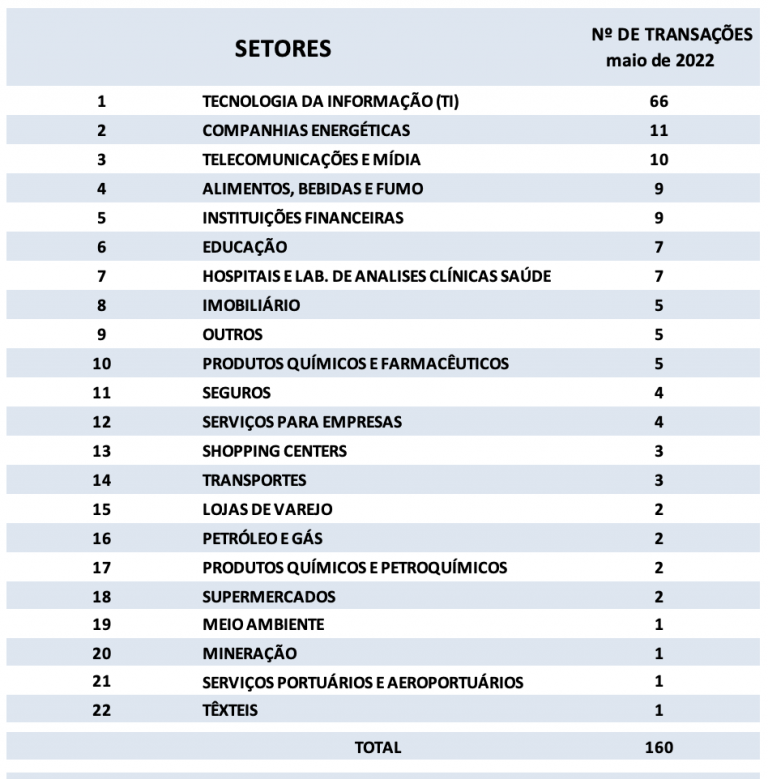

In the month of May, 160 transactions were carried out, growth of 11.9% compared to the previous month and investment of R$ 34.9 billion, a decrease of 38.6%. If compared with the same month of the previous year, the falls were 7.1% in volume and 27.8% in investments.

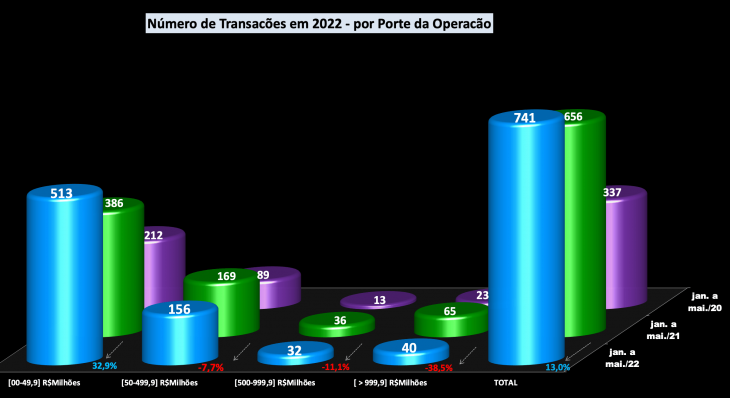

In the first five months of the year, with 741 operations and investments of R$ 196.4 billion, it represents growth of 13.0% in volume and a reduction of 27.8% in value, in relation to the same period of last year.

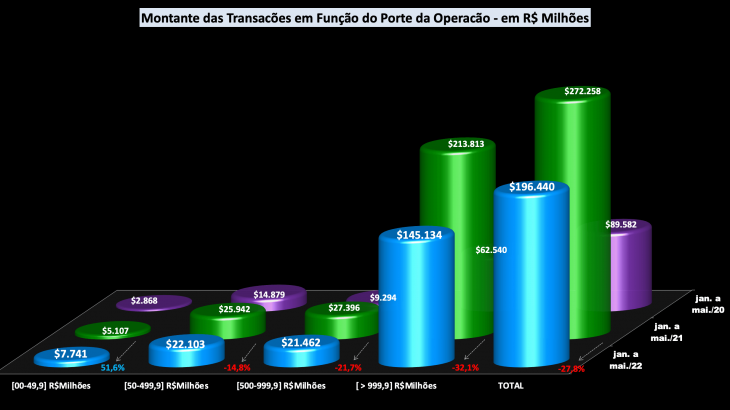

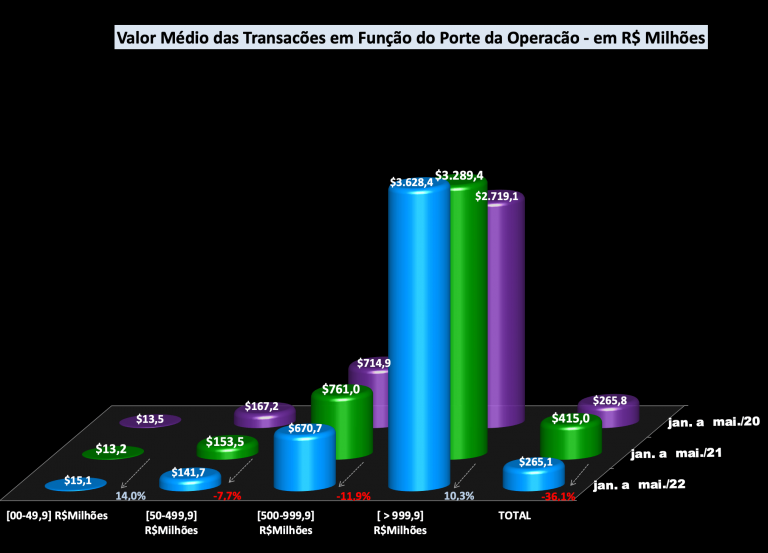

Both the volume and the investments of transactions in the first five months of the year, with a size above R$ 1.0 billion, were those that showed the biggest drop.

The volume and investments made in operations of up to R$ 50 million were the only ones that showed growth, of 32.9% and 51.6%, respectively.

Average value of transactions in the first five months of the year registers a drop of 36.1% in relation to the same period of last year.

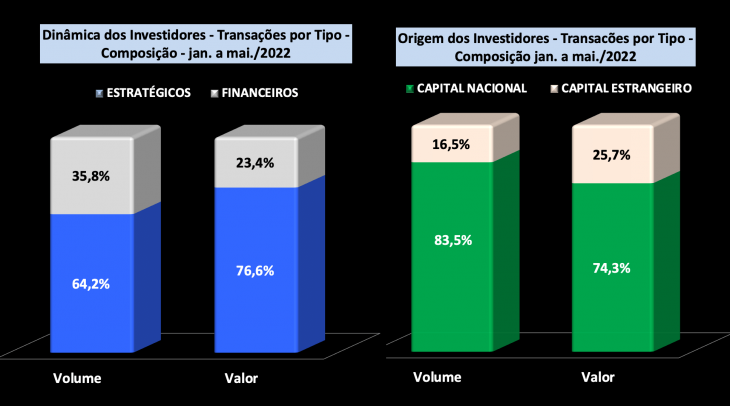

Predominance of Strategic Investors with growth of 16.4% in volume compared to the 5 months of last year and a drop of 9.0% in investments.

Financial investors registered an increase of 7.3% in volume and a decrease of 57.0% in the amount of investments accumulated in the year.

National investors with greater appetite in the first 5 months of the year, registered 619 deals, a growth of 13.6%, and the amount of R$ 145.9 billion, with a decrease of 33.5%.

In the year, Foreign Investors registered 122 deals, a growth of 9.9%, and a reduction of 4.3% in the value of investments.

29 deals carried out by investors from 13 countries were mapped. The US, with 15 operations and investment of around R$ 5.5 billion, was the one with the greatest appetite.

Biggest transaction of the month of May/2022:

Energy companies accounted for 2 of the 5 biggest deals this month. Eneva acquires Celse thermal for R$6.1 billion and advances with a gas “hub” project.

Analysis of the Month

Maintained industry concentration

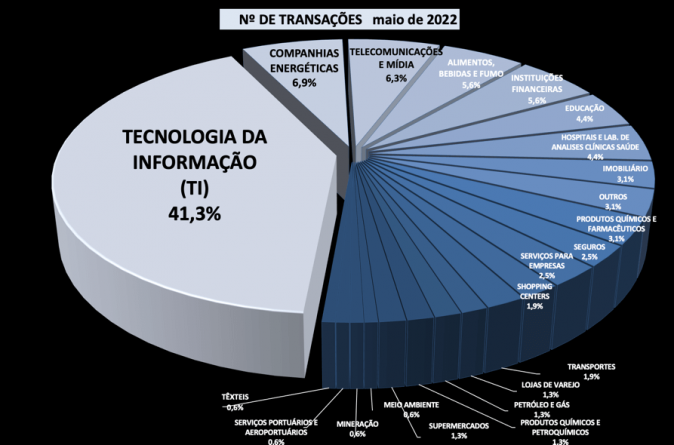

The 5 most active sectors accounted for 65.6% of total operations in May/22, against 67.6% in the same month of last year, maintaining practically the same level of concentration as the TOP 5.

Growth of 11.9% in the number of operations compared to the previous month.

In the month of May, 160 transactions in 22 sectors of the Brazilian economy were highlighted by the press, registering an increase of 11.9% in relation to the previous month (143 transactions).

Comparing with the same month of the previous year, there is a growth of 15.1%, when 139 deals were verified.

Evolution in the last 5 years

In the first five months of 2022, 741 operations were calculated, registering a growth of 13.0% compared to the same period of 2021, when 656 operations were carried out.

Greater appetites x greater falls.

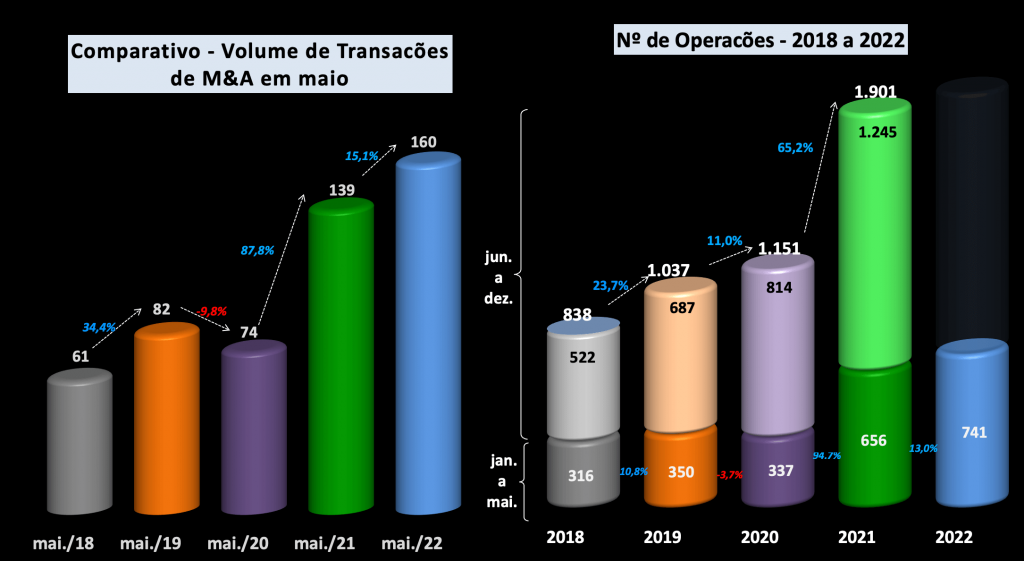

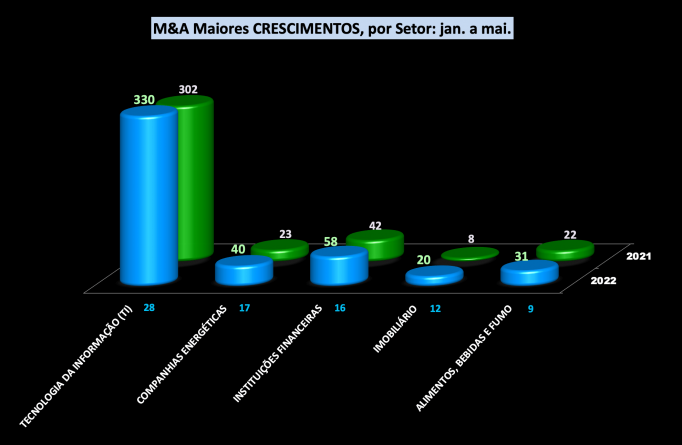

Most representative sectors in the first five months. In the graph of the most active sectors in the accumulated result for the current year, in addition to IT, Financial Institutions and Energy Companies stand out.

In the accumulated result for the year, the segment with the highest growth in the number of transactions in relation to the same period last year was IT, with an increase of 28 operations, followed by Energy Companies and Financial Institutions.

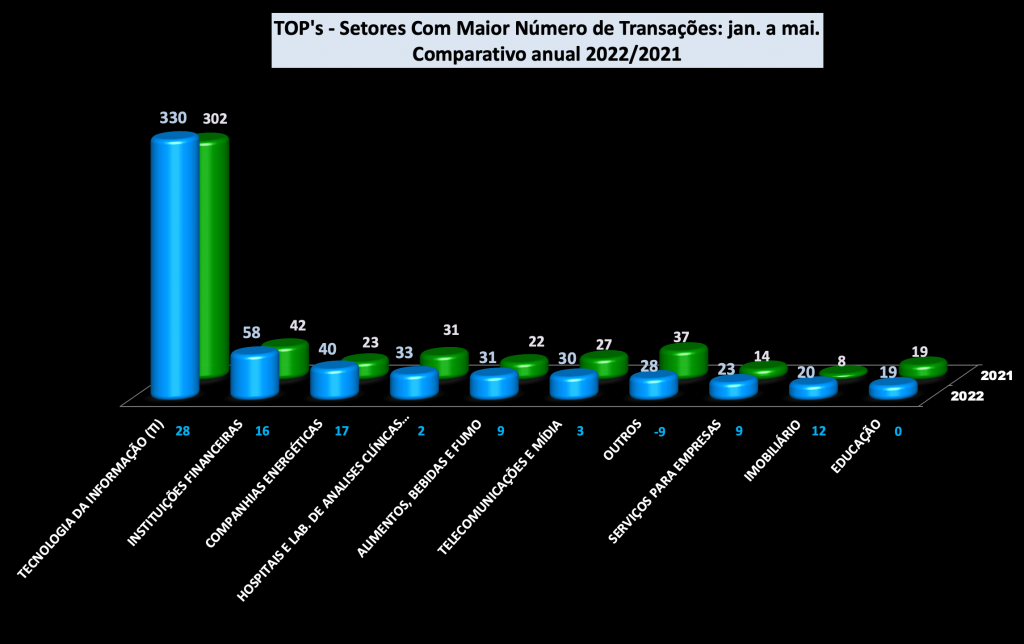

Resumption of momentum in the accumulated volume of transactions over the last twelve months.

The month of May/22 resumes growth, practically constant over the last two years – since Jul/20 – in the accumulated number of transactions. The biggest drop occurred at the height of the pandemic and for a short period of 4 months – between Mar/20 to Jun/20.

May registers an increase of 1.1% in the number of M&A transactions accumulated in the last twelve months, with 1,986 operations, compared to the same period of the previous month. In relation to the same accumulated period of the previous year – May/21, the increase is 35.1%.

In the cumulative graph, one can infer different cycles of growth and decline in the number of transactions. Probable factors that are having the greatest impact on investment expectations are highlighted. The chart also includes (i) the evolution of the historical series of the BOVESPA index (performance of shares traded on B3), in the same period, and (ii) the evolution of the exchange rate.

Two years ago, March was marked as the beginning of the pandemic in Brazil and the fall continued in April. The same phenomenon is repeated two years later.

The first five months of 2022 were marked by Russia’s invasion of Ukraine and the end of the public health emergency of national concern of the covid-19 pandemic.

Dollar closes the month of May with an increase of 3.86%. The Ibovespa, the main index of the Stock Exchange, rose by 3.22%.

size of transactions

Of the 160 transactions verified in the month, 102 are up to BRL 49.9 million – 63.8% of the total and accounted for 4.6% of its value. In the accumulated result for the year, for this same size of operations, 513 transactions were registered, representing 69.2% of the total and 3.9% of the value. And it impacts a growth of 32.9% in relation to the same period of the previous year.

The volume of transactions accumulated in the year above BRL 1.0 billion were those that showed the biggest drop, of 38.5%

Comparing the shares of transactions according to size in the first five months of the year, it allows identifying the variation in volume – percentage – over the last 3 years.

The most significant structural change compared to the same period last year is the growth in the volume of small transactions up to R$50 million.

Decrease of 7.1% in the amount of investments compared to the same month of the previous year

As for the amounts of trades carried out in the month, a total of R$ 34.9 billion is estimated. It represents a decrease of 7.1% in relation to the same month of the previous year – considering Disclosed Values (84.3%) and Undisclosed/Estimated Values (15.7%). In relation to the previous month, there was a significant drop of 38.6% when it reached the amount of R$ 56.8 billion.

Reduction of 27.8% in the amount of investments accumulated in the year. As for the amounts of business carried out in the year, a total of R$ 196.4 billion is estimated, representing a drop of 27.8% compared to the same period of 2021.

Investments made in operations of up to R$ 50 million were the only ones that showed growth – 51.6%. Investments in operations above one billion reais had the biggest drops.

Comparing the participation of transactions in the first five months of the year, it allows identifying the variation in investments – percentage – according to size, over the last 3 years. The most significant change is the reduction in investments in transactions greater than R$1.0 billion.

Average value of transactions

Average value of transactions in the first 5 months of the year recorded a drop of 36.1% compared to the same period last year. The average value of transactions carried out in the year reached BRL 265.1 million, against BRL 415.0 million in the same period of 2021, representing a reduction of 36.1%.

The drop in the average value accumulated in the year was due to transactions ranging in size from R$500.0 million to R$1.0 billion, compared to the same period of the previous year.

Dynamics & Origin of Investors

Strategic Investors

Growth of 16.4% in volume compared to the accumulated result of last year and a drop of 9.0% in investments – The biggest appetite this month was due to Strategic investors with 107 operations (66.9%), and they accounted for 88 .9% of the amounts invested. In the accumulated result for the year, Estrategicos, with 476 operations, grew by 16.4% compared to last year. They accounted for 62.3% of business and 60.7% of investments, amounting to BRL 165.3 billion, which means a 9.0% drop compared to the same period of 2021.

Financial Investors

Financial investors grew 7.3% in volume and a 57.0% drop in the amount of investments accumulated in the year. They carried out 53 operations in the month of May in the amount of R$ 3.9 billion. In the accumulated result for the year, financial investors reached 265 operations – growth of 7.3% – corresponding to 35.8% of trades and 23.4% of investments, in the amount of R$ 46.0 billion, representing a decrease of 57. 0% compared to the same period of the previous year.

National Investors

Domestic Investors with greater appetite in the accumulated result for the year, growth of 13.6% in volume and decrease of 33.5% in amount. National Capital investors were responsible in the month for 131 operations, 81.9%, and investment of around R$ 21.2 billion, corresponding to 60.9% of the total. In the accumulated result for the year, nationals were responsible for 619 operations – growth of 13.6% in relation to the previous year, and accounted for 83.1% of operations. The investment was around R$ 145.9 billion, equivalent to 74.3% of the total, corresponding to a drop of 33.5% in relation to the same period of the previous year.

Foreign Investors

In the year, Foreign Investors recorded growth of 9.9% in the volume of transactions and a reduction of 4.3% in the value of investments. Foreign Capital investors carried out 29 operations in the month – 18.1% of the total, amounting to R$ 13.6 billion – 18.1% of the total. In the accumulated result for the year, Foreign operations with 122 operations registered a growth of 9.9% – they accounted for 16.5% of the transactions. Investments reached the amount of R$ 50.5 billion (25.7%), which means a 4.3% reduction compared to the same period in 2021. It is important to mention that the information available on investments in relation to IPOs, on B3, are treated as national capitals on the date of publication of this report. As for joint investment contributions from several Private Equity funds, the nationality of the leader of the block is considered.

In May/22, 29 deals carried out by investors from 13 countries were mapped.

The US, with 15 operations, had the greatest foreign appetite in the month and an investment estimated at R$ 5.5 billion.

Biggest transactions in the month of May/2022:

Energy companies accounted for 2 of the 5 biggest deals this month.

Eneva acquires Celse thermal for BRL 6.1 billion and advances with gas “hub” project – Eneva announced on Tuesday night an agreement for the acquisition of Celse, one of the largest gas-fired thermoelectric plants in operation in Latin America, for 6.1 billion reais, in a transaction that expands its portfolio of generation assets and positions it to create a gas “hub” on the Brazilian coast.

BR Properties sells assets to Brookfield group for R$5.92 billion – This Wednesday, BR Properties announced agreements for the sale of a series of important buildings and interests in real estate projects held by the company in cities including Rio de Janeiro, São Paulo and Brasília .

Follow news through the website https://pipeline.capital

and also from LinkedIn

and Instagram