To say that this industry enters 2023 in a whirlwind would be an understatement.

Text by Pyr Marcondes, Senior Partner at Pipeline Capital.

The digital assets market, still in consolidation around the world, is extremely vulnerable to its own uncertainties and contradictions.

To say that this industry enters 2023 in a whirlwind would be an understatement. The 12 months leading up to the new year were brutal for the digital asset market.

The sector has been plagued by scandals, catastrophic company collapses, falling cryptocurrency valuations, falling funding levels and customers fleeing the sector to place their investments in more noticeable savings havens.

Of these, the FTX implosion was the one that most impacted the market. In November 2021, cryptocurrencies like bitcoin hit their all-time high in value. In the months following the scandal, they lost about two-thirds of that amount, shaving about $2 trillion from their total capitalization.

For Luciano Britto, Founder and CEO of the Rhizom blockchain platform, “the role of exchanges should, inexorably, boil down to ensuring that an exchange can take place with guarantees for both parties (buyer and seller), that is, making it impossible for one embezzles the other. Exchanges should not hold customer assets, much less offer financial assets as derivatives”.

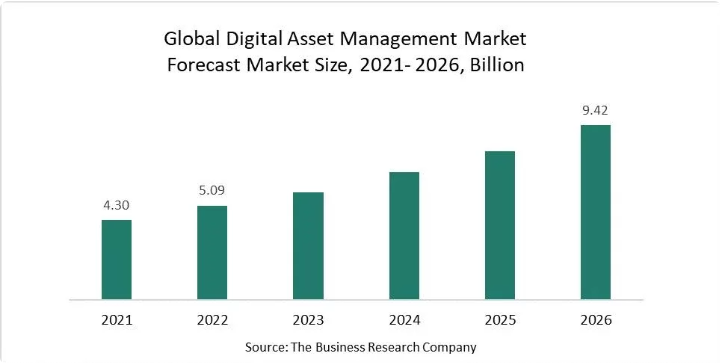

Even so, because it is inevitable and because technology will always remain the path to the financial market, the projections for the sector, regardless of the short term, are promising.

Basic definitions still under construction

As Delloite’s study on the crypto asset market reminds us: “When we talk about crypto assets, the first idea that comes to mind is bitcoin, followed by other token currencies. But the term “crypto asset” encompasses much more than just payment cryptographic”.

Thus, a global consensus emerged regarding the division of crypto assets into a few key archetypal assets:

Payment/Exchange (e.g. bitcoin and equivalents)

Security (investment components including ownership and promise of future cash flows)

Utility (access to specific products, services or protocols).

These assets can also be combined in various hybrid forms.

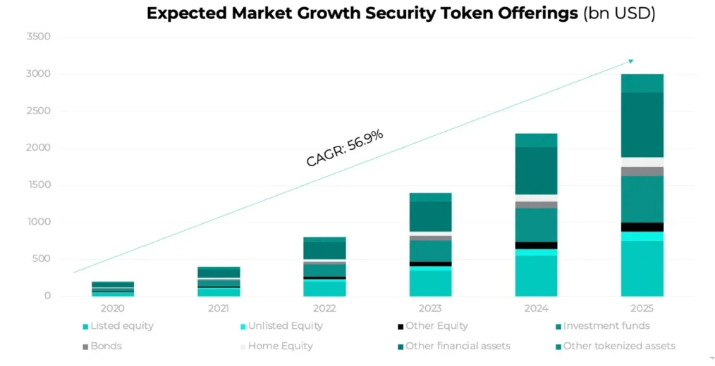

Still for Deloitte, security tokens will be the big bet in the financial market

Tokens still have a long way to go before they can be considered mainstream, but a number of countries and central banks are now, with some speed, creating regulations for them (the case of Brazil).

This presupposes the complexity of inserting them into a Distributed Ledger Technology (DLT) ecosystem, considering issues related to the primary market (issuance/notary services), trading and post-trading (clearing and settlement), and custody and custody services.

Deloitte is categorical in stating: “The security token is the financial security of the future”.

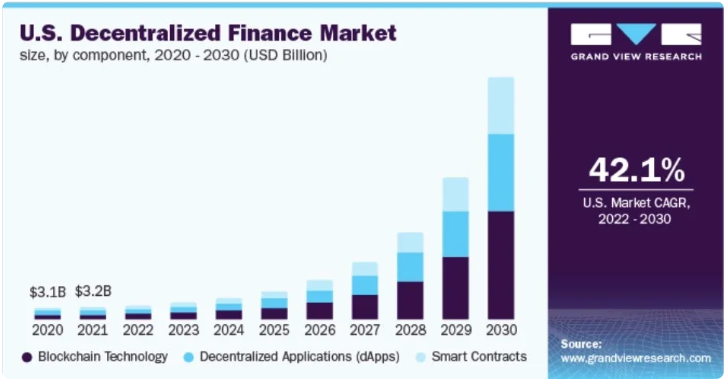

A decentralized financial world

Programmable, traceable and automated money on Blockchain platforms.

This is the basic structure of what is called DeFi, Decentralized Finance, or decentralized financial market.

In it, exchanges are also decentralized (DEX) and automated. Trades are P2C (peer-to-contract), no third-party custody, no counterparty risk.

It also includes smart contracts (Smart Contracts), all always under the encrypted security of the blockchain.

In this new environment, central banks do not act as financial market gate keepers and transactions are guaranteed by the technology itself.

DeFi has grown. From October to November 2022 alone an increase of 68%, with volume of $97B.

In summary, DeFi enables asset management through secure smart contracts that make liquidity flows more transparent and ensure greater control over investments. And it should be a dominant financial trend in the near future.

Reversal volatility

The feeling of uncertainty will not change overnight and unequivocal transparency of the digital crypto asset sector seems to be the watchword in this market.

The crypto industry’s problems are somehow linked to the same volatility that has plagued the rest of the technology-based industries. Shares of major companies in the sector plummeted as the threat of a recession increased. Bankruptcies and painful mass layoffs followed.

However, as Maria Lema, co-founder of Weaver Labs, points out, “even with everything we face in 2022, 2023 should be reminiscent of the cryptographic winter of 2019, especially in the cases of new projects and Web3 fundraising. We can expect to see more equity-based funding and less DAO investment. As seen in 2019, most Web3 startups will have to show progress and KPIs to close capital rounds. This will be reflected in the traction and adoption metrics. The hype will also become a thing of the past, replaced by a more real implementation. Realistic use cases for blockchain will get more support. It will be prime time to show how blockchain, cryptocurrencies and decentralized technology are a solution to real problems in many industries. With the hype gone, only projects that drive real value will progress, which will ultimately help with adoption.”

*This article is an integral part of the study, still unpublished, “THE FUTURE OF INVESTMENTS – An overview of the macroeconomic scenario and the probabilities of financial market behavior in 2023. And beyond.”, by the Pipeline Tech Investment Group.

Text by Pyr Marcondes, Senior Partner at Pipeline Capital.

Follow news through the website https://pipeline.capital

and also from LinkedIn

and Instagram