Text by Pyr Marcondes, Senior Partner at Pipeline Capital.

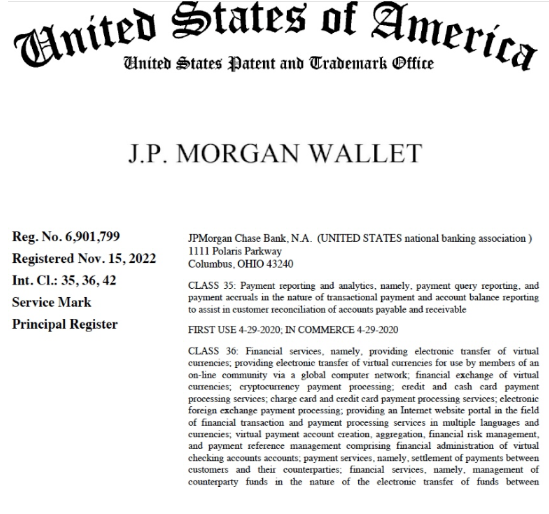

This image below is a landmark. This is the copy of J.P. Morgan.

As we know, traditional financial institutions strongly turn their nose up at the crypto world. They do this because they understand that it is a disruptive ecosystem that is still full of uncertainties (and it is), unregulated (it is not), that every now and then exposes its weaknesses (which in fact happens), and that maintaining the status it in the face of innovative challenges of this nature is always the most appropriate posture. Well, it was.

The world of crypto assets in general will still have to go through a tortuous, but inevitable, path towards its consolidation. It’s part of the journey of every disruptive transformation.

In the financial market, these transformations face fierce resistance because we are talking about money. From the mainstay of everything capitalism knows as economics and business. Don’t mess with it easily. Nor speed.

However, it is exactly in the financial market that we have been witnessing the most profound disruptions with the advent of fintechs, which turned upside down this very conservative and change-resistant industry.

Crypto is not, and will not be, any different.

Below, I’ve gathered some facts from the US financial press that show how J.P. Morgan began to relax and I’ll explain why this is emblematic: J. P. Morgan is valued at US $ 390.26 billion and is the largest financial institution in assets in the US, which in turn is the largest economy in the world. That alone would be enough. But an organization of this size and relevance being among the first in this type of initiative is what really surprises and impacts.

This is a sign that this is a path and a platform that needs to be tested in practice and made available, as a portfolio of services, to its customers.

Recently, on November 2, the bank successfully executed its first decentralized (or DeFi) financial trade that took place on the Polygon blockchain network.

Jamie Dimon, CEO of the financial institution, surprised everyone by saying recently that Bitcoin has “significant advantages”. He was already in the oven, of course, the idea of registering his crypto wallet brand.

Dimon’s statement came as a shock because he and the bank he runs have always been known to be skeptical of cryptocurrencies and the effects they have on today’s financial system.

Last August, it was revealed that J.P. Morgan has quietly moved behind the scenes in the market to give its wealth management clients access to a total of six crypto funds through a program that was implemented last July.

Now, on November 15, the United States Patent and Trademark Office (USPTO) has granted the bank the trademark application for J.P. MORGAN WALLET, (the one above) which will allow it to offer a cryptocurrency wallet for transferring and exchanging digital currency. It will also allow the bank to process cryptographic payments and offer its exclusive customers virtual checking accounts.

It will also cover other related financial services such as counterparty funds and wire transfer management.

The US trade press reminds us that this decision by J.P. Morgan to have its own crypto wallet adds to its efforts to explore new ways to incorporate blockchain technology into its services, with the aim of not falling behind in the digital transformation of the industry and providing secure exposure to crypto assets for its clients.

In other words, emblematic is not enough. It’s a deposit check for the future.

Text by Pyr Marcondes, Senior Partner at Pipeline Capital.

Follow news through the website https://pipeline.capital

and also from LinkedIn

and Instagram